Model Signals

Model Signals translates the Quant Pack's Leading Indicators into asset allocation insights to help with tactical trading, idea generation, risk management, and bespoke model development. You can find more information on each indicator and its latest model signal in the MarketDesk Quant Pack, which is published each Friday.

Model Signal Framework

Asset Allocation Insights

-

A library of model signals that are based on the Quant Pack indicators and designed to identify the most likely path forward for markets. The systematic framework employs a weight-of-the-evidence approach that is designed to (1) minimize false signals and (2) optimize the risk/reward outcome for each portfolio decision.

-

The model signals can be used to inform asset allocation positioning, guide tactical trading, enhance risk management, and develop bespoke models. The list of model signals is updated each week with the release of the Quant Pack newsletter.

-

Key Benefits: Efficient, consistent, and repeatable.

Equity Sector Rotation

Model Portfolio Signal

-

The Equity Sector Rotation Model owns either S&P 500 Cyclical Sectors (Industrials, Materials, & Consumer Discretionary) or S&P 500 Defensive Sectors (Utilities, Health Care, & Consumer Staples).

-

The model signal is based on the Quant Pack Leading Indicators. Each indicator is translated into a forward-looking 'Risk-On' or 'Risk-Off' equity positioning signal.

-

The signal report provides sample returns since 2000 and includes performance statistics, relative returns vs the benchmark, and portfolio drawdowns.

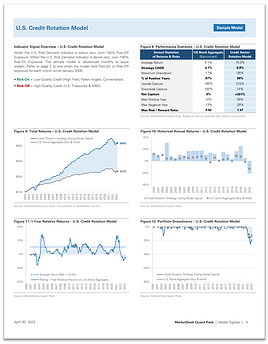

Credit Sector Rotation

Model Portfolio Signal

-

The Credit Sector Rotation Model owns either Low-Quality Credit Sectors (High Yield Bonds, Fallen Angel Bonds, & Convertibles) or High-Quality Credit (U.S. Treasuries & Mortgage Backed Securities).

-

The model signal is based on the Quant Pack Leading Indicators. Each indicator is translated into a forward-looking 'Risk-On' or 'Risk-Off' credit positioning signal.

-

The signal report provides sample returns since 2000 and includes performance statistics, relative returns vs the benchmark, and portfolio drawdowns.

Stock/Bond Rotation

Model Portfolio Signal

-

The Stock / Bond Rotation Model owns either the S&P 500 Index (stock exposure) or the U.S. Bloomberg Bond Aggregate Index (bond exposure).

-

The model signal is based on the Quant Pack Leading Indicators. Each indicator is translated into a forward-looking 'Risk-On' or 'Risk-Off' stock vs bond positioning signal.

-

The signal report provides sample returns since 2000 and includes performance statistics, relative returns vs the benchmark, and portfolio drawdowns.